branding

marketing

sales

tech

websites

....

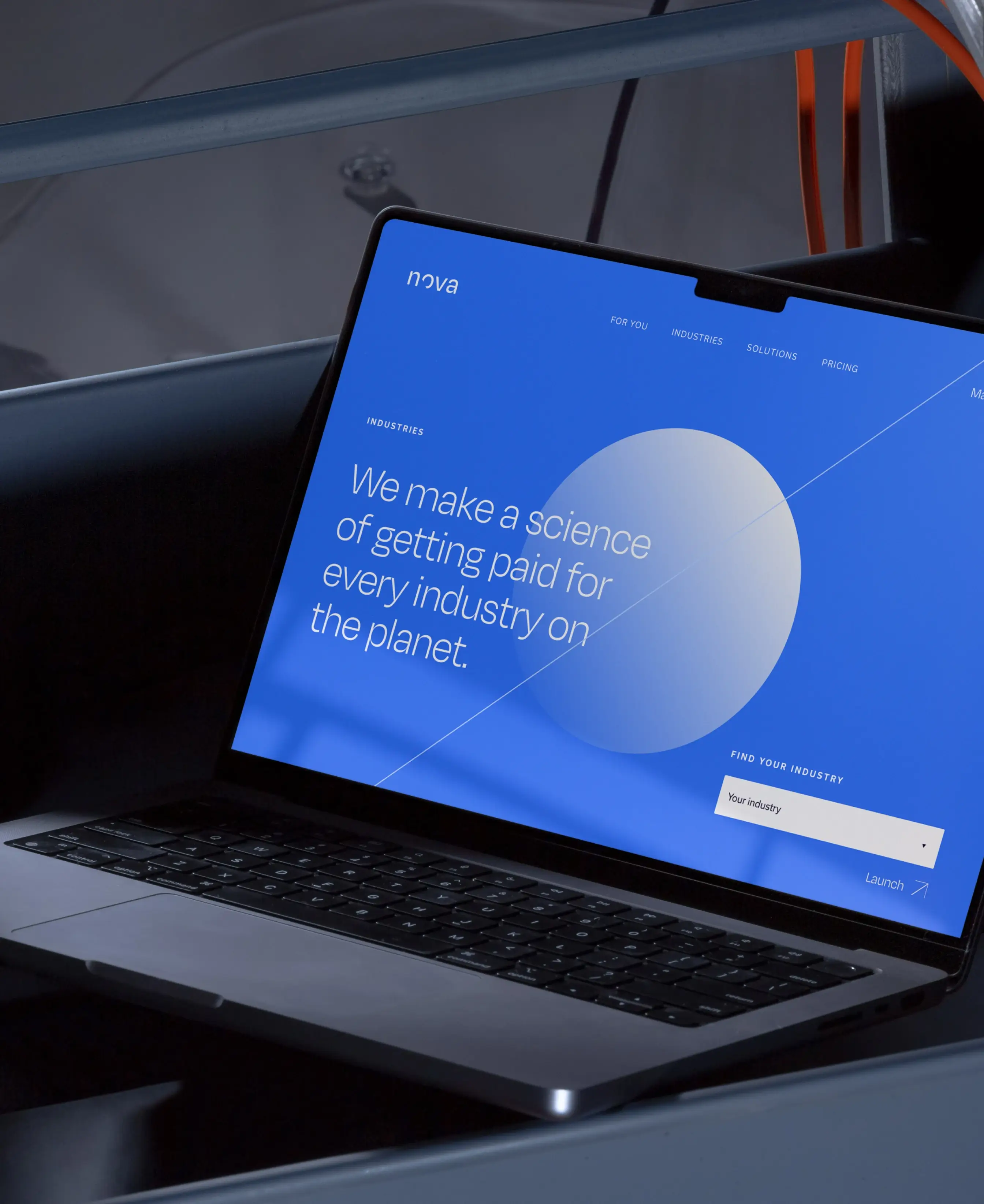

Nova Tech needed a marketing partner

The science of getting paid

branding

marketing

sales

tech

websites

....

Making Geniusto investor-ready

More brains behind your banking

View All

Featured Work

Learn More About Us

What we do

We champion bankable business growth with full-service branding, marketing, sales and tech services. We’re the link between the great business you’ve built and a larger world seeing you in a new light.

Before you’re big enough to build a world-class team, you tap our team to get there. We’re your firepower from breakthrough branding and sales enablement to unforgettable websites and campaigns.

digital veterans of integrated marketing.

creative champions of business growth.

we take you higher.